What's New with Zeta Joint Cards? Product Updates

August 12th, 2021 | 5 mins

Our team at Zeta has been hard at work to make life easier for you and your team at home. In fact, one of our biggest goals at Zeta is to help you achieve your goals. Here’s the lowdown on what's new with Zeta Joint Cards.

Prioritize your Goals

Like most people, you’re probably working towards multiple milestones at once. On Zeta Joint Cards, you can now organize your Goals in the order that's most important to you and your partner. Discuss amongst yourselves…

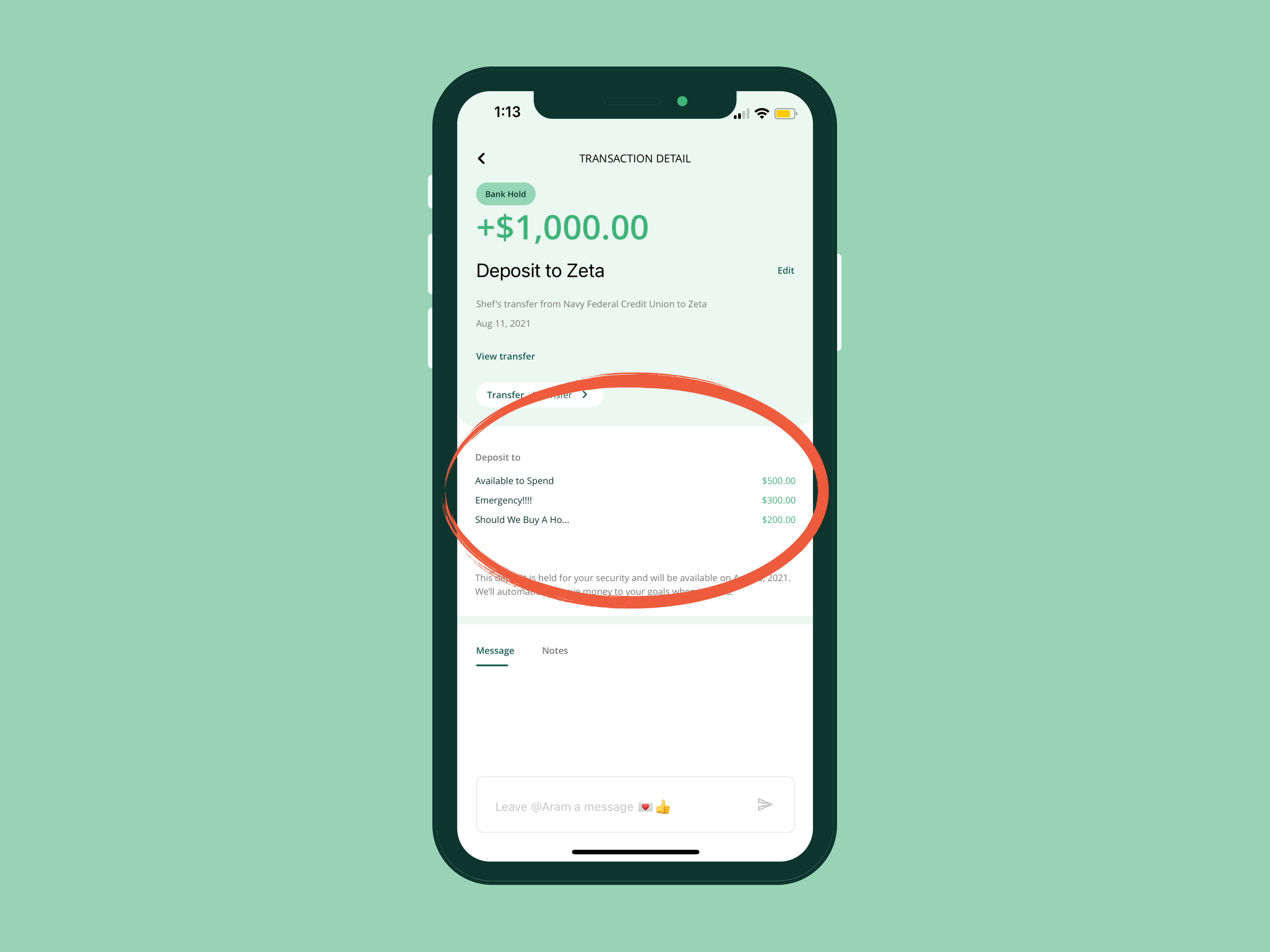

Track transfers to multiple goals more easily

Transferring to multiple Goals? We got you. We’ve improved the design of transfers destined for multiple Goals so it’s clearer when the transfer will be deposited and where it’s going.

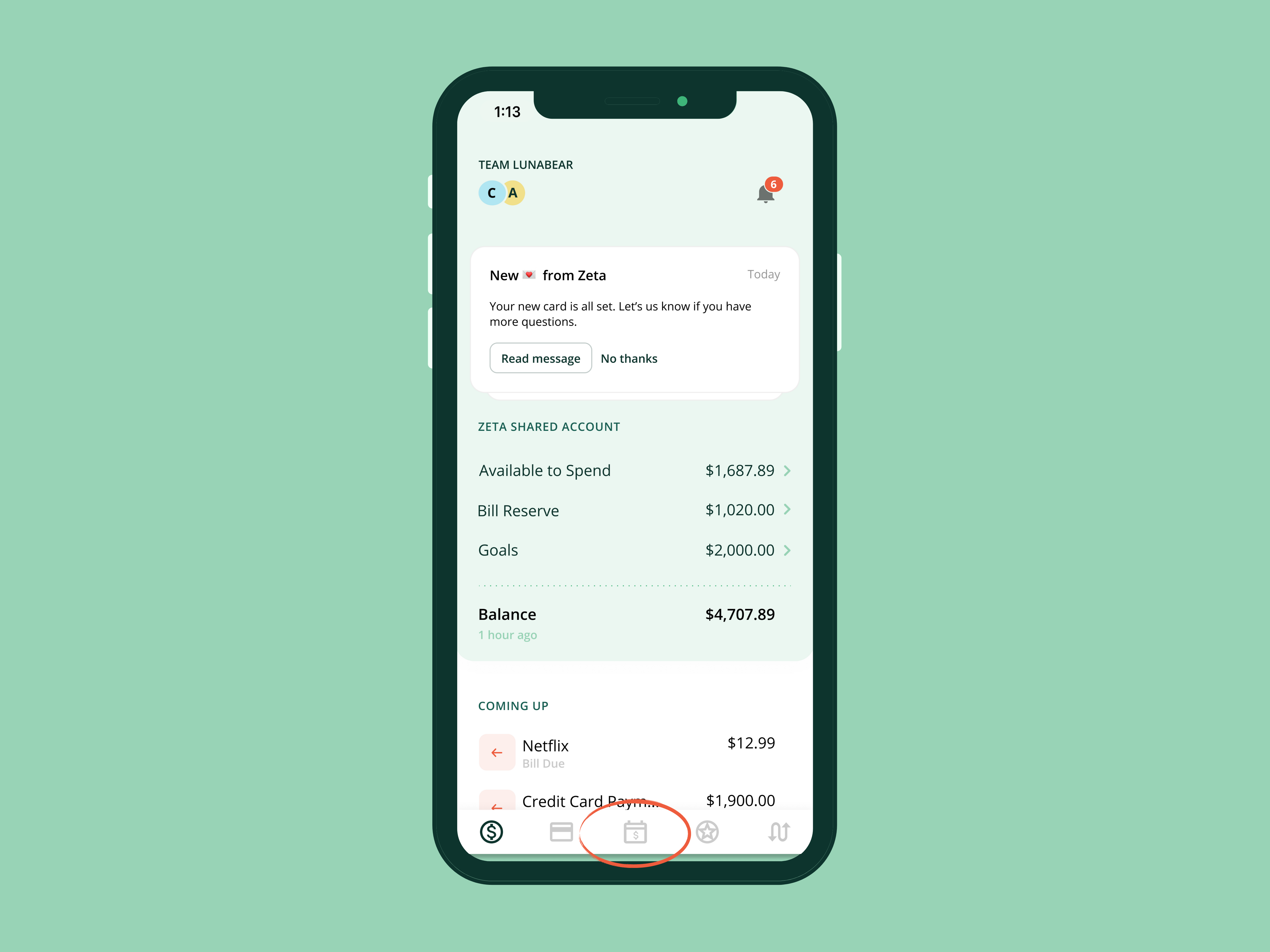

Navigate easier

We know managing bills can be everything from a pain in the butt to oh-so-satisfying. Whatever the vibe, we’ve seen that Zeta couples love setting aside money for upcoming bills. We've updated the app’s navigation so it’s even faster and easier to get to your Bill Reserve.

Stay in the know

Sometimes, the bank is slow to send your next credit card statement. Don't worry, Zeta will let you know when we're waiting for new info.

Support has a new home

You can reach out to Zeta Concierge by heading to alerts and clicking on the question mark in the upper right corner. We're here to help with any problems, mysteries, or questions—or just chat, if that's what you're into.

Did you enjoy this article?

A newsletter designed to help

you achieve relationship goals.

A newsletter designed to help you achieve relationship goals.

To safely consume this site, we recommend reading this disclaimer. Any outbound links will take you away from Zeta, to external sites in the world wide web. Just so you know, Zeta doesn’t endorse any linked websites nor do we pay/bribe anyone to appear on here. Any reference to prices on the site are just estimates; actual prices are up to specific merchants and their current desire to charge you for things. Also, nothing on this website should be construed as investment advice. We’re here to share our favorite tools, tactics and tips for managing your money together. This content is for your responsible consumption. Please don’t see this as a recommendation to buy specific investments or go on a crypto-binge. Lastly, we 100% believe that personal finance is exactly that, personal. We may sometimes publish content on this website that has been created by affiliated or unaffiliated partners such as employees, advisors or writers. Unless we explicitly say so, these post do not necessarily represent the actual views or opinions of Zeta.

By using this website, you understand the content presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy.

1Zeta is a financial technology company, not a bank. Banking services provided by Piermont Bank; Member FDIC. All deposit accounts of the same ownership and/or vesting held at the issuing bank are combined and insured under an FDIC Certificate of $250,000 per depositor. The Zeta Mastercard® Debit Card is issued by Piermont Bank, Member FDIC, pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted.

2Zeta Annual Percentage Yield (APY) is effective as of 01/01/2025, for customers who qualify for VIP status. Minimum amount to open an account is $0.00. Minimum balance to earn the APY is $0.01. Interest rates are as follows: 1.94% APY applies to the entire balance for customers who qualify for VIP status. Interest rates may change after the account is opened. Fees may reduce earnings.