Manage Your Wedding Budget Like A Boss With These Spreadsheets

August 1st, 2019 | 5 mins

You’re getting married! As you bask in the excitement of your engagement, some part of you might be wondering how you’re going to pay for it all. But fret not, creating a budget is one of the best ways to make sure you don’t empty your bank account on your big day.

Weddings have a ton of moving parts, so keeping track of where your money is going and what you still have left to pay is crucial. Having a wedding budget calculator, like a spreadsheet, is essential.

To help you prep, we’ve created a spreadsheet template to lend you a hand in organizing and managing your money.

Start by understanding your overall budget

Before diving into the ins and outs of our wedding budget template, let’s start with what you’re hoping to spend. Fun fact, the average wedding in the US costs over $30K.

Start by putting in your total target budget and see how that breaks down into various costs (eg. vendor, flowers, etc). Getting this birds-eye perspective sets you up for wedding budget success!

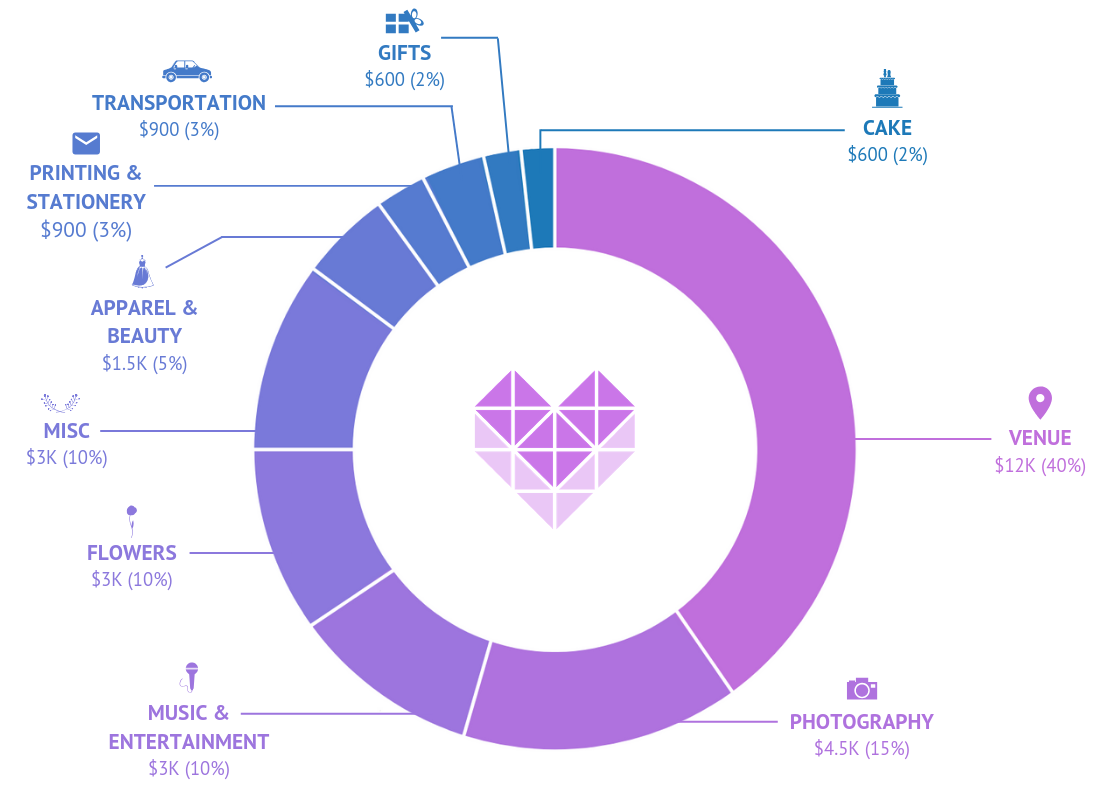

Here’s a breakdown based on the average wedding cost of $30,000:

This high-level budget should give you a chance to have an informed conversation with your soon-to-be spouse. If you’d prefer to prioritize one area over another (eg. venue over flowers), make adjustments that feel right for you as a couple. To do this, you can edit the percentages in column C directly on the spreadsheet.

Next, break down your expenses

Based off of research you and your S/O have done, begin filling out your estimated costs for all of the different wedding categories. If there are specific categories that you won’t be spending anything in, you can leave them blank. As you fill in the estimates, the Total Estimate column will populate with the total of all costs you’ve entered. This will give you immediate feedback on how your target budget lines up with your estimated one.

If you’re over your target number, here are some tips to cut costs:

- If you have friends that bake or do photography, see if they’d be willing to offer their services at a discounted price for you.

- Wedding cakes can get pricey. Consider having an elegant dessert table instead or spice one up from Costco!

- Choose a venue that lets you bring your own alcohol and purchase from a liquor store that will take back unopened bottles.

- If your wedding will be on the smaller side, you can always book a beautiful mansion or estate through Airbnb or Venues & Vows. Then you can get your wedding catered and save on food big time.

If you’re under your target, rejoice! But in all seriousness, it’s a good idea to leave some wiggle room in your budget as a safety net. There’s always the possibility that you’ll have a change of mind with something and it may end up costing a little more than what you’d planned. Need some inspiration? Check out this couple who had a $3,000 wedding from stuff they got on Amazon!

Nail down your vendors & contracts

Once you’ve signed contracts and nailed down different vendors for your wedding, you can start filling out the costs in the “Actual” section in the wedding budget template. You’ll notice that the “Outstanding” column will populate for those specific items, which is the amount that you still owe the vendor. The “Total Actual” column will also populate with all of the actual costs you’ve entered. Now, you can compare what you estimated against what the actual costs turned out to be to see how well you’ve stuck to your budget so far.

As you begin paying your vendors, you can start to fill out the “Paid” column of those categories (and feel that sweet, sweet feeling of accomplishment). Your “Outstanding balances” will decrease for those items and the “Total Paid” column will increase.

Once you start using this spreadsheet, keep going strong! As more information rolls in, continue to update your wedding budget calculator so you know exactly where you stand.

Stay on track with your budget

Creating your wedding budget and managing it through a spreadsheet is one thing, but actually staying on track can sometimes be challenging. Especially when your Instagram is poppin’ off with wedding-related ads now! The key is prioritization. Are orchids or lilies a must-have at your wedding? Put those at the forefront of your expenses and cut costs elsewhere that you care less about (eg. transportation).

BONUS SECTION: Venue cost comparison spreadsheet

By far, the biggest expense of your wedding is going to be the venue. On your journey to finding the perfect one, you’ll discover that venue costs often aren’t presented apples to apples. Some places charge for everything separately and some ask for a fixed amount. Keeping tabs on all of this information in a spreadsheet will help to keep everything organized! Within our wedding budget calculator is another tab labeled “Venue Comparison” that allows you to do just that.

Using our venue cost comparison spreadsheet allows you to see, side by side, the difference in costs between each venue you’re considering. Here are some tips on using it:

- Enter your headcount in the gray box. After adding per person meal costs (buffet and/or plated), the “Total Meal Costs” columns will populate with the entire cost of food for that particular venue.

- “Total Venue Cost” isn’t calculated by a formula so you can enter a lump sum, if needed. Just sum up the cost columns you care about in this total column.

- Change the column labels or add in new columns for anything else you’re considering (like a Sunday venue price).

- Often, then are hidden expenses that may not be mentioned upfront. Ask the venue coordinator about these costs (like parking fees, coat checking, and cake cutting).

Once you’re done gathering all the info you need from each venue, take a good look at what you’re working with! The side-by-side comparison will be so helpful in choosing the right venue for your big day.

Ready to start managing your wedding budget like the boss you are?

Did you enjoy this article?

A newsletter designed to help

you achieve relationship goals.

A newsletter designed to help you achieve relationship goals.

To safely consume this site, we recommend reading this disclaimer. Any outbound links will take you away from Zeta, to external sites in the world wide web. Just so you know, Zeta doesn’t endorse any linked websites nor do we pay/bribe anyone to appear on here. Any reference to prices on the site are just estimates; actual prices are up to specific merchants and their current desire to charge you for things. Also, nothing on this website should be construed as investment advice. We’re here to share our favorite tools, tactics and tips for managing your money together. This content is for your responsible consumption. Please don’t see this as a recommendation to buy specific investments or go on a crypto-binge. Lastly, we 100% believe that personal finance is exactly that, personal. We may sometimes publish content on this website that has been created by affiliated or unaffiliated partners such as employees, advisors or writers. Unless we explicitly say so, these post do not necessarily represent the actual views or opinions of Zeta.

By using this website, you understand the content presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy.

1Zeta is a financial technology company, not a bank. Banking services provided by Piermont Bank; Member FDIC. All deposit accounts of the same ownership and/or vesting held at the issuing bank are combined and insured under an FDIC Certificate of $250,000 per depositor. The Zeta Mastercard® Debit Card is issued by Piermont Bank, Member FDIC, pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted.

2Zeta Annual Percentage Yield (APY) is effective as of 01/01/2025, for customers who qualify for VIP status. Minimum amount to open an account is $0.00. Minimum balance to earn the APY is $0.01. Interest rates are as follows: 1.94% APY applies to the entire balance for customers who qualify for VIP status. Interest rates may change after the account is opened. Fees may reduce earnings.