Our Camper Van Dream: From Apartment Life to Financial Freedom

August 6th, 2021 | 13 mins

What led us to live and travel in a van?

Hi, we are Brett and Sam. We’re from small towns and small families in the midwest. We both moved to Arizona for work around 2016—Sam a nurse, and Brett working at a tech startup. That’s where we first met in the winter of 2017 thanks to online dating.

Next thing you know—we had our own place and were engaged and trying to figure out what we’d like to do with our future together (along with Freya, our dog).

We had so many ideas in the early stages of our relationship:

- Stay in Arizona, buy a house

- Move back to the midwest closer to family and build a house

- Travel to Europe, find work there

While the possibilities seemed endless, we realized there was a pretty obvious hurdle we’d have to overcome: money.

We both made a comfortable income. The issue was that we were a little loose with our finances in our early 20s, which led to us having a few too many credit cards and other miscellaneous debt. We also had some medical bills we wanted to pay off. Nothing too crazy, but too much to decide to do something big that could put us further in debt.

With our dreams wilting a little, we decided a change of scenery and a little adventure could be good for us while we figure out what’s next. We took jobs in Houston in the spring of 2019. Picking up our lives and moving on a whim like this was scary for us, but we were excited. We learned a lot about our relationship throughout the move and we feel it brought us closer.

Brett: “Planning out our finances was our greatest challenge when we decided to move across the country. At the time, we had a joint checking account and our individual accounts. We had a lot of tough talks about what it would cost to move. Deposit (and pet fees, ugh) on a rental home, gas money to get there, a rental truck for all of our stuff. The list goes on. While neither of us felt comfortable talking about money, I feel it’s much easier to have financial conversations now because of those early conversations we pushed ourselves to have.”

We got married in July of 2019 and spent a couple of years in Houston. Visiting some beaches, lakes, and mountain bike trails across Texas, and even a trip to NYC for a week helped reaffirm that we loved the outdoors and travel—and we wanted more of it. The feeling we had, tied down to the house we rented, stuck in Houston with jobs that made it difficult to travel—reminded us of those feelings back in Arizona when we had discussed different possibilities for our future that seemed so impossible due to circumstance and finances.

This time was a little different though. Financially, we were in a better place. We had a couple years of experience working to accomplish our goals together. The pandemic, though serious and tragic, offered us a lot of time at home to think about what our next move could be. While bored on the couch day after day, we found the van life community online. Whether it was Eamon and Bec traveling Canada and Europe or Trent and Allie traveling North and South America in camper vans they built out themselves, we loved every minute of what we saw. We started to think about what it would be like for us to do something similar. Many in the van life community had expressed how free it felt both emotionally and financially to travel and live a nomadic lifestyle. We were hooked.

Sam, looking back at it now, what’s the number one reason you wanted to build your own camper van and travel? “Getting out of the rent trap. We were just wasting money month after month paying to live in a space that we didn’t own. Traveling in the van is comfortable and affordable and gives us the chance to explore places we could potentially call home in the future.”

So how did we do it? What did it take to plan, budget, and build?

Step 1: Manage our debt

We mentioned previously that questionable financial choices in our 20s were going to make it difficult to make big choices in our future. We didn’t do a whole lot to fix that in the few years we were together. We made some small dents, but there were still some things to deal with.

We started by pledging to eliminate unnecessary spending. No more credit use. No buy now, pay later. If we didn’t need it, we wouldn't buy it. Whether it was slimming down the grocery list by $50 a week, not buying shiny new tech, or choosing to cook at home versus going out, we started to see the fruits of our labor pretty quickly. We used that extra money to pay off thousands of dollars in medical bills and credit cards. Everything was looking up.

We crunched some numbers and realized that once we were traveling in the van, our expenses were going to be far less than apartment life. We knew then we could take that extra savings and put it towards the rest of our debt. Once we had some of our medical bills paid for, we started to make plans to shift some money towards the build.

Step 2: Plan the build, save some money

While we were on the hunt for the perfect van, we started to plan out what exactly we’d need to do to make this happen. We built spreadsheets for parts we would need and the general plan for the build. We didn’t have a hard budget since we hadn’t done anything like this before and were generally unfamiliar with the process. We knew we wanted the build to cost no more than around $20K, not including the cost of the van. Since we were doing all of the work ourselves, all that mattered was the cost of parts and materials. The first draft of our list was around $15K.

Lastly, we developed the layout of the build by mashing together the different parts of builds we had fawned over on social media. We knew we wanted A LOT of battery power to be off-grid as much as we’d like, a shower and toilet, and a full kitchen with running water. If we were going to do this, we were going to go all the way. We didn’t want to live in something we had compromised on so we tried our best to incorporate as much normal-house-life into the build.

Now that we had a general idea of what we were in for, we started to direct some money towards the “van build fund.” We built out a Goal on our Zeta Joint Cards account and started to funnel money into it every couple of weeks or so.

Step 3: Have our bank accounts do the work for us

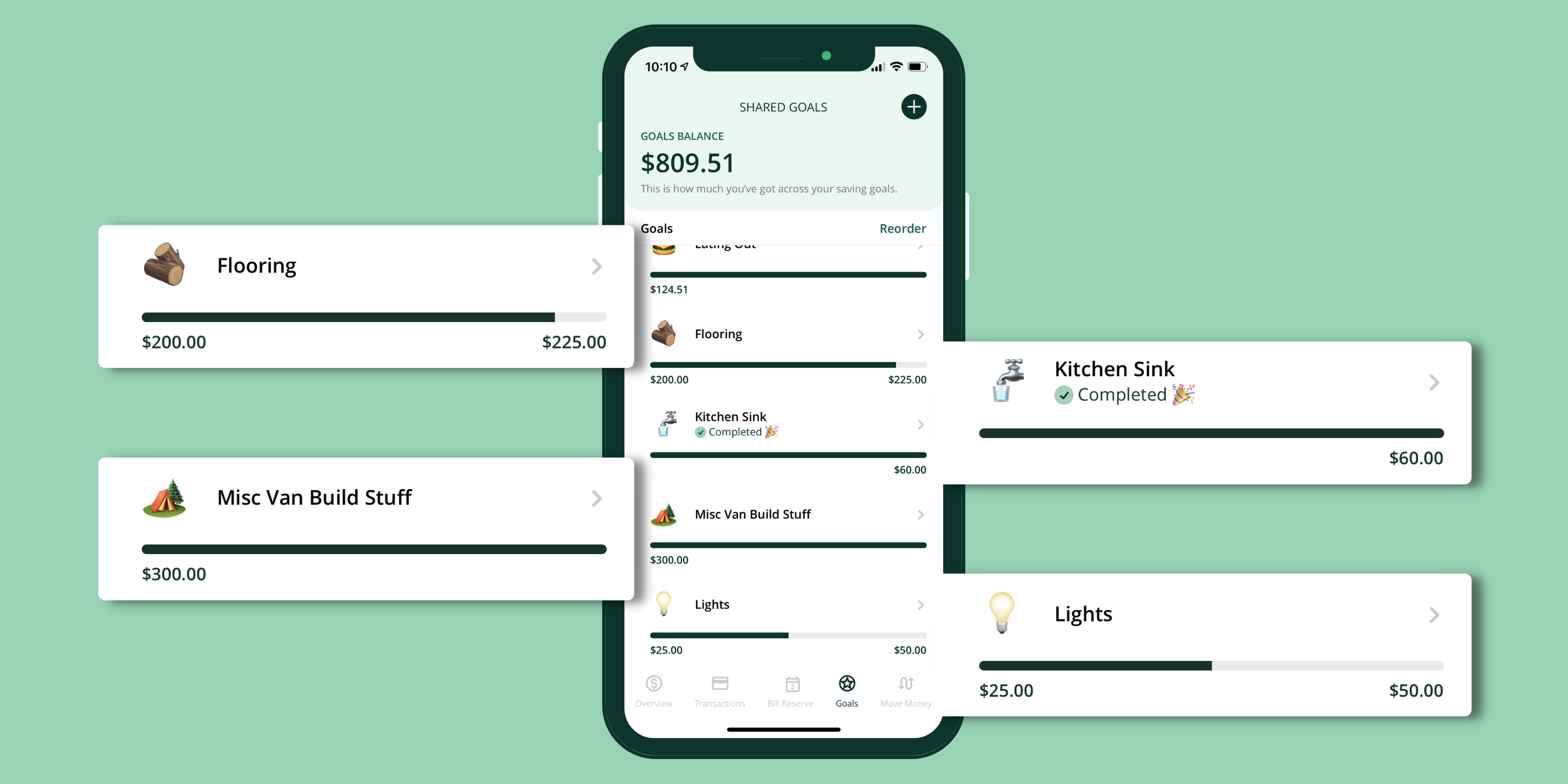

In more traditional accounts, you usually just have one or two “buckets” that represent your money. Usually, it’s just the checking account and maybe a savings account. What we liked about Zeta is that you can organize your money in near-infinite ways.

In the beginning, we created a Goal in our Zeta Joint Cards account for the van build. Looking back, I believe we just named it “The Van Build,” ha. This was great to have because now we had a place to stash money within our account just for the build, without affecting our other bills and Goals we had.

Our strategy was to use our Zeta Joint Cards account to make sure our monthly bills had the money they needed in the account’s Bill Reserve, and that necessary Goals we had set up (for gas, groceries, etc.) also had the money they needed each week. Anything extra went in the van build Goal. We did this for a few months and we had about $6K saved up. Not too shabby!

Without being able to sort our account into individual Goals, we would have had to use an external service or spreadsheet to do this. That would have introduced a lot of room for inaccuracies, not to mention all the extra work Sam and I would’ve needed to do to keep an external system up to date. Having it built into our Zeta Joint Cards account meant we could trust what our financial situation looked like with real-time accuracy and little to no effort.

Now that we had a growing chunk of change, we started to create Goals for specific higher dollar items we needed, like the refrigerator, batteries, solar panels, and bed. Every couple of weeks, we’d discuss where we should allocate money after budgeting weekly and monthly expenses. We’d then move some money from the general van build Goal into the Goals we built for the specific items. If we had any “leftover” money after everything was said and done, we’d toss it into the general van build Goal.

This meant that the general van build Goal was a buffer we’d use on things we didn’t anticipate or smaller purchases not worth tracking more granularly. This strategy worked pretty well, and we kept it up throughout the entire building process.

Step 4: Build the van while staying true to our financial strategy

A few months later, we bought the perfect van from a local dealer at a great price. Before that, we each had our own vehicles. It really didn’t make much sense to add the van as a third, so we decided to sell Brett’s car. It was easier to justify financing a reasonable monthly payment for the van that way—essentially the money we were budgeting each month for Brett’s car we just swapped for the van’s. Yay, no extra monthly costs! The van payment was a quarter of what we paid to rent the house we had, so in the end, we felt we were coming out ahead. We also had an asset to keep once the van payments were taken care of, which is much more than you can say for renting a house or an apartment.

So now we had the van and were excited to get started on the build. We only had six months until the lease on our rental home was up. It was a race against the clock. This is where we struggled the most. It was important to us to pay for this build-out of pocket as much as possible. We didn’t want to create more debt to pull this off.

Our strategy was simple. If we didn’t have the money, we wouldn’t make a purchase. There were very few instances where there was a massive purchase we needed to make and would put it on a credit card, only to pay it off in a matter of weeks. Our electrical system (batteries and solar panels) was so expensive, it still pains us to think about to this day.

Beyond that exception, we only bought things with the money we had set aside in our Zeta Joint Cards account. If we needed to wait until we got paid again to make a purchase, we waited. With our move-out date from the rental house looming, this was very difficult to do, but we’re proud of sticking to our strategy as best we could.

We spent many nights and weekends working on the build. (Our total estimate is about 500 hours.) We put more effort into this than quite possibly anything else in our lives up to that point. It was hard, and we knew very little about what we were doing, and spent lots of time learning from various blogs and YouTube videos. About five months later the van was done, Brett had found a fully remote job (at Zeta, no less!—more on that another time) and we were excited to start our new life.

Step 5: Move in, travel, and pay off debt!

As we write this article, we’ve lived in the van for a little over four months, along with Freya, and a new member of our family—our cat, Luna. It hasn't leaked, it hasn't molded, and we're not dead yet, so we think we did well enough.

We’ve traveled over 5,000 miles, been across the country twice, stopping at many places and making many memories along the way. Sam’s next travel nursing opportunity will take us to Delaware for three months. We’re excited to leave Texas behind, and start the next chapter of our lives.

Since living in the van and traveling, we’ve paid off over $25,000 in debt and will be relatively debt-free in about eight weeks.

We’ve been employing a similar strategy to pay off debt as we did to save for and build the van. We created Goals in our Zeta Joint Cards account for the debt we’d like to clear, and each week we got paid, we’d throw as much at it as we could. First, we’d make sure our bills and general expenses were taken care of, add a little to our savings/emergency fund, and then the rest went to debt. Week by week, our debt started to shrink. Nothing feels better than seeing a zero balance on your credit cards, bills, and loans.

Sure, we could’ve paid down our debt with the money we used to build the van. But then we’d still be wasting money on an apartment, wouldn’t have gotten the opportunity or flexibility to travel, and we’d be no closer to understanding where and what we’d like to do next. In the beginning, we felt the risk was worth it, and as we sit here now we believe it has been.

So, what’s next?

Well, that’s the question of the year for us now. We have a loose plan on what we want to do. We’ll save the details for another (possible) article but will share a little of what excites us for the future.

Through building and living in the van, we’ve come to like the idea of alternative living spaces. We’ve seen houses made out of shipping containers. We’ve seen massive yurts that families have called home. The creativity and ingenuity to do something different and challenge yourself to live more off-grid and reliant on the land around you is very intriguing. We want to build a larger tiny house on wheels, something about 30-feet long that’s built on a trailer. After that, we want to buy some land to park our tiny house on while we spend a few years planning and building a home. Brett also has a dream to buy an old live-aboard sailboat, renovate it, and travel the world on it—but that may remain just a dream for a while longer.

Did you enjoy this article?

A newsletter designed to help

you achieve relationship goals.

A newsletter designed to help you achieve relationship goals.

To safely consume this site, we recommend reading this disclaimer. Any outbound links will take you away from Zeta, to external sites in the world wide web. Just so you know, Zeta doesn’t endorse any linked websites nor do we pay/bribe anyone to appear on here. Any reference to prices on the site are just estimates; actual prices are up to specific merchants and their current desire to charge you for things. Also, nothing on this website should be construed as investment advice. We’re here to share our favorite tools, tactics and tips for managing your money together. This content is for your responsible consumption. Please don’t see this as a recommendation to buy specific investments or go on a crypto-binge. Lastly, we 100% believe that personal finance is exactly that, personal. We may sometimes publish content on this website that has been created by affiliated or unaffiliated partners such as employees, advisors or writers. Unless we explicitly say so, these post do not necessarily represent the actual views or opinions of Zeta.

By using this website, you understand the content presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy.

1Zeta is a financial technology company, not a bank. Banking services provided by Piermont Bank; Member FDIC. All deposit accounts of the same ownership and/or vesting held at the issuing bank are combined and insured under an FDIC Certificate of $250,000 per depositor. The Zeta Mastercard® Debit Card is issued by Piermont Bank, Member FDIC, pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted.

2Zeta Annual Percentage Yield (APY) is effective as of 01/01/2025, for customers who qualify for VIP status. Minimum amount to open an account is $0.00. Minimum balance to earn the APY is $0.01. Interest rates are as follows: 1.94% APY applies to the entire balance for customers who qualify for VIP status. Interest rates may change after the account is opened. Fees may reduce earnings.